RESOURCES

Employee vs Independent Contractor: What’s the Difference?

Introduction

- Overview of the employee vs independent contractor debate.

- Importance of understanding the distinction for both workers and employers.

Understanding the distinction of employee vs independent contractor is crucial for both businesses and workers in today’s evolving workforce. Proper classification impacts everything from taxes and legal obligations to job security and benefits. Understanding each role can help ensure that both parties are protected and compliant with regulations, whether a company is looking to hire long-term employees or bring on contractors for short-term projects, or an independent professional is looking for their future work.

Definition of an Employee

- Characteristics of an employee.

- Employer control over the work schedule, location, and tasks, W-2 form.

An employee is a worker who operates under the direct control and supervision of an employer, typically following set schedules, performing tasks as instructed, and working at specific locations. Employees are integral to a company’s operations and are usually paid regularly through a salary or hourly wage, receiving a W-2 form for tax purposes. Employees are often eligible for benefits such as health insurance, retirement plans, and paid time off. According to the IRS, “You are not an independent contractor if you perform services that can be controlled by an employer (what will be done and how it will be done)”.

The defining feature of an employee in the employee vs independent contractor comparison is the level of control an employer has over their work. Employers dictate the tasks, work hours, and location, which sets employees apart from contractors who enjoy more flexibility.

Definition of an Independent Contractor

- Characteristics of an independent contractor.

- Flexibility in work and autonomy over tasks

- Tax forms like 1099

An independent contractor is a self-employed individual or business that provides services to another entity under terms specified in a contract or agreement. Unlike traditional employees, independent contractors typically operate with a significant degree of freedom and autonomy. They are responsible for setting their own hours, managing their tasks, and determining how best to complete the work. One of the key characteristics of an independent contractor is flexibility. They have the freedom to choose when and where they work, and they are not usually bound by a rigid schedule set by their client. This autonomy extends to how they execute tasks, as long as they meet the agreed-upon outcomes, giving them control over their work process.

Another way to determine an employee vs independent contractor is from a tax perspective. Independent contractors receive a 1099 form instead of a W-2. This form reports the income they earned from clients but does not include deductions for taxes. It is the contractor’s responsibility to manage and pay their own taxes, including self-employment tax, making their financial obligations distinct from those of traditional employees.

Key Differences of Employees vs Independent Contractors

- Work Schedule

- Compensation

- Benefits

- Taxation

- Job Security

To dive deeper into the employee vs independent contractor comparison, one of the major differences lies in work schedules. Employees usually have set hours established by their employer, while independent contractors enjoy the flexibility to create their own schedules. This allows contractors more freedom to balance multiple projects, clients or personal responsibilities.

When it comes to compensation, employees are generally paid a regular salary or hourly wage, while independent contractors are paid per project or task. The payment structure for contractors can vary, but it typically reflects the nature and scope of the work completed, rather than time spent on the job.

Another key difference is the benefits provided. Employees often receive benefits such as health insurance, retirement plans, and paid leave. Independent contractors, however, are not entitled to such benefits and must secure their own health and retirement plans.

Taxation also varies between the two groups. Employees receive a W-2 form, and their employers handle tax withholdings. Contractors, on the other hand, receive a 1099 form and are responsible for paying their own taxes, including self-employment tax, directly to the IRS.

Lastly, job security is a crucial differentiator. Employees often have permanent or long-term positions with a company, offering stability. Independent contractors, however, work on a contract basis, meaning their work is temporary and often tied to specific projects or timeframes.

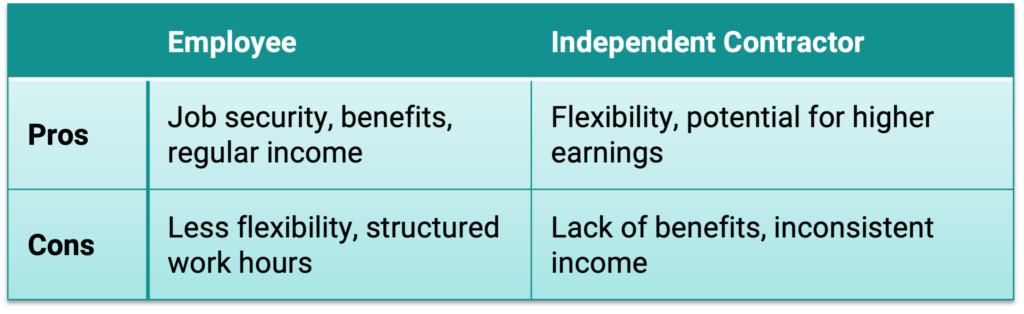

Employee vs Independent Contractor Pros and Cons for Workers

Being an employee or an independent contractor comes with distinct advantages and drawbacks. For employees, one of the most significant benefits is job security. Employees typically enjoy a stable, predictable income with consistent pay periods. They also often receive benefits such as health insurance, retirement plans, and paid time off, providing financial and personal security. However, the downside is the lack of flexibility. Employees are generally expected to work set hours and follow structured routines, which can limit their control over their schedules.

On the other hand, independent contractors experience much greater flexibility. They have the freedom to set their own hours, choose their projects, and often work remotely or on their own terms. This autonomy can lead to potentially higher earnings, especially for those who manage multiple clients or specialize in high-demand services. Despite these advantages, independent contractors face the downside of inconsistent income, as their earnings depend on the availability of projects. Additionally, they do not receive traditional employee benefits, such as health insurance or retirement plans, making them responsible for securing these on their own.

Employee vs Independent Contractor Pros and Cons for Employers

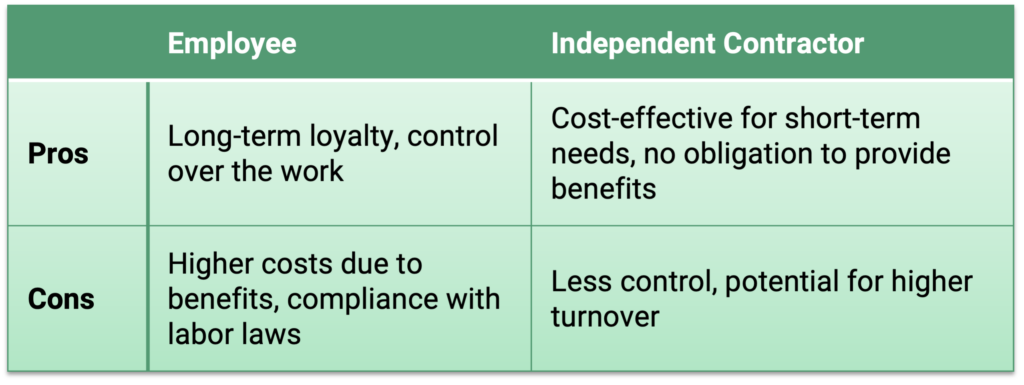

When hiring employees, employers benefit from long-term loyalty and control over the work. Employees are more likely to develop a deep understanding of the company and its processes, fostering commitment and stability. Employers can also provide detailed oversight, setting specific expectations for how and when tasks should be completed.

However, hiring employees comes with higher costs. Employers often provide benefits such as health insurance, retirement contributions, and paid leave. Additionally, they are required to comply with labor laws, including payroll taxes and regulations regarding overtime, which can increase operational expenses.

In contrast, hiring independent contractors can be more cost-effective, especially for short-term projects or specialized tasks. Employers pay only for the hours worked or the outcomes and are not obligated to provide benefits or contribute to contractors’ taxes, reducing financial and administrative burdens.

However, this arrangement comes with its own challenges. Employers have less control over contractors, who maintain autonomy over how they complete their work. This can lead to inconsistencies in the final product or process. Additionally, contractors often work on a project-by-project basis, which can result in higher turnover and the need to continually source new talent.

Legal and Tax Implications for employee vs independent contractor classification

- IRS criteria for classifying workers.

- Employment laws regarding misclassification.

- Tax obligations for employers and workers.

The IRS has specific criteria for classifying workers as either employees or independent contractors, focusing on the level of control and independence in the working relationship.

These criteria fall into three main categories:

- Behavioral control (how much direction the employer has over the work),

- Financial control (how the worker is paid and whether expenses are reimbursed),

- The nature of the relationship (whether benefits are provided and if the relationship is ongoing).

Properly classifying workers is essential to avoid legal and financial consequences, such as penalties, back taxes, and fines. To avoid misclassification, employers should evaluate the nature of the working relationship, focusing on control and independence. Employees are generally subject to greater control by the employer, while independent contractors have more freedom. Employers should also consult IRS guidelines, like the “common law test,” which assesses control over the worker. Additionally, documenting the terms of the working relationship in contracts and maintaining consistent classification practices across the company can prevent disputes.

Employers must comply with labor laws and be familiar with federal and state regulations, as definitions of “employee” and “independent contractor” vary by jurisdiction. Some states use the stricter “ABC test” for worker status. Ensuring employees receive the benefits required by law, such as minimum wage and overtime, is crucial. Misclassification can result in penalties, back taxes, and lawsuits, while proper classification ensures compliance with tax obligations—employees require tax withholdings, while independent contractors handle their own taxes. Regularly reviewing classifications and seeking legal advice can help prevent costly errors.

When to Hire an Employee vs. Independent Contractor

- Long-term, ongoing work vs. short-term, project-based needs.

- The strategic decision based on company growth and flexibility needs.

One of the key distinctions when deciding between hiring an employee or an independent contractor is the nature of the work involved. For long-term, ongoing tasks that require consistent attention and involvement, hiring a full-time employee is often the better choice. Employees are typically more integrated into the company, participating in the day-to-day operations, and are expected to grow with the organization over time. In contrast, independent contractors are ideal for short-term, project-based needs. Contractors often bring specialized skills to a particular project and work on a temporary basis, making them ideal for companies with fluctuating workloads or specific tasks that don’t require permanent staff.

The decision to hire an employee or an independent contractor also depends on the company’s strategic goals, particularly regarding growth and flexibility. Companies experiencing rapid growth may benefit from the stability and loyalty that come with hiring full-time employees, as they can be more easily aligned with the company’s culture and long-term objectives. On the other hand, businesses looking to maintain flexibility and reduce overhead costs may prefer to hire independent contractors, as they can be brought in as needed without the obligations of providing benefits, payroll taxes, or long-term commitments. This allows the company to scale its workforce up or down according to project demands, while still accessing specialized expertise.

Conclusion

- Recap of the differences between employee vs independent contractor.

- Final thoughts on making the right classification decision for both workers and employers

In summary, the primary differences between hiring an employee vs an independent contractor revolve around the nature of the work and the level of control and commitment required. Employees are better suited for long-term, ongoing tasks where the employer needs consistent engagement and direct oversight, while independent contractors are ideal for short-term, project-based assignments that demand specialized skills and greater autonomy. Each option offers distinct advantages depending on the company’s needs for stability, growth, or flexibility.

Making the right classification decision is crucial for both workers and employers to ensure legal compliance and foster positive working relationships. Employers must carefully evaluate the job’s requirements and adhere to guidelines that define the worker’s status, while workers should be aware of the rights and obligations associated with their classification. By taking a strategic approach and ensuring accurate classification, businesses can avoid costly penalties, and both parties can enjoy the benefits that come from a well-structured working arrangement.