Introduction

- Overview of the importance of filing taxes for self-employed individuals.

- Key differences between self-employed taxes and employee taxes.

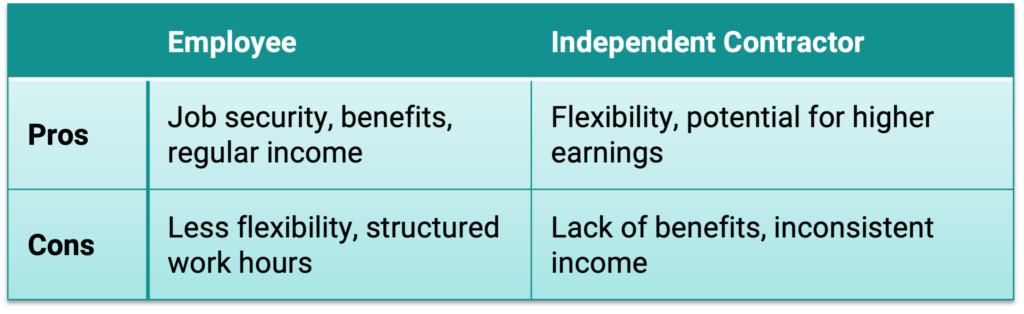

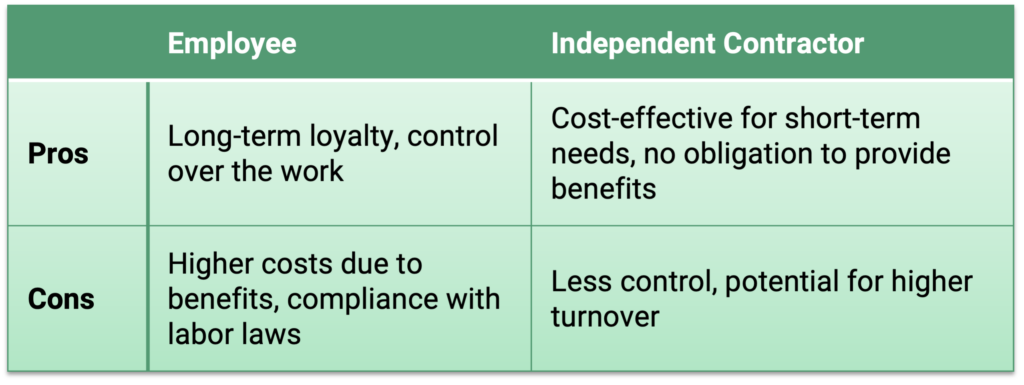

- Brief mention of tax obligations for different types of self-employed professionals.

Filing taxes for self-employed individuals is essential for accurately reporting income, staying compliant with tax laws, and managing financial health. Unlike traditional employees, self-employed professionals are responsible for calculating and paying both income tax and self-employment tax, which covers Social Security and Medicare contributions typically handled by employers.

Whether you’re a freelancer, independent contractor, or small business owner, understanding tax obligations is crucial. Self-employed individuals often need to file quarterly estimated tax payments, report business expenses, and track income more closely than employees. By meeting these requirements, self-employed taxpayers can avoid penalties and maximize available deductions, making filing taxes for self-employed income a central part of running a successful business.

Understanding Self-Employment Tax Obligations

- Explanation of self-employment tax (Social Security and Medicare).

- Self-employment tax rate and how it differs from traditional payroll taxes.

- Who is considered self-employed for tax purposes.

Filing taxes for self-employed requires a clear understanding of self-employment tax obligations, as this includes both Social Security and Medicare contributions that are normally shared between employers and employees.

For the self-employed, the full self-employment tax rate is 15.3%, covering 12.4% for Social Security and 2.9% for Medicare. This differs from traditional payroll taxes, where employees only pay half of these contributions, with employers covering the rest.

Anyone earning $400 or more annually as a sole proprietor, freelancer, or independent contractor is required to pay self-employment taxes. Understanding these obligations is essential for accurately filing taxes for self-employed income, helping individuals meet requirements, avoid penalties, and maintain eligibility for Social Security benefits.

Required Forms for Filing Self-Employed Taxes

- Overview of key forms needed:

- Form 1040: For reporting personal income.

- Schedule C (Profit or Loss from Business): Reporting income and expenses.

- Schedule SE: For calculating self-employment tax.

- Other potential forms, like Form 1099-NEC for contractors and freelancers.

Form 1040 is the main tax form used by all U.S. taxpayers to report their annual income and calculate their income tax. It is on Form 1040 that self-employed taxpayers report their overall income, claim deductions, and calculate their tax liability, including self-employment tax. After filling out Form 1040 and all required schedules, taxpayers use it to determine their total tax owed or refund due.

Schedule C is specifically for self-employed individuals, including freelancers, sole proprietors, and independent contractors, to report income and expenses related to their business. This form is essential for calculating the business’s net profit or loss, which is then transferred to Form 1040 as part of total income.

Schedule SE is used to calculate self-employment tax, which covers Social Security and Medicare contributions for self-employed individuals. Since self-employed taxpayers don’t have an employer covering part of these contributions, they are responsible for paying the full self-employment tax rate of 15.3%.Schedule SE calculates this amount based on the net profit from Schedule C, and the resulting tax is then reported on Form 1040.

Another potential required from when filing taxes for self-employed individuals is the 1099-NEC, a tax form used to report payments made to self-employed individuals, independent contractors, freelancers, and other non-employees.

Businesses are required to file this form with the IRS and provide a copy to the contractor if they paid $600 or more to a non-employee during the tax year for services rendered. The form reports nonemployee compensation, which includes fees, commissions, prizes, and awards paid to independent contractors.

Estimating and Paying Quarterly Taxes

- Why self-employed individuals need to pay estimated taxes quarterly.

- How to calculate estimated payments and due dates.

- Penalties for underpayment or missed quarterly payments.

Self-employed individuals are required to pay estimated taxes quarterly because they do not have taxes withheld from their income like traditional employees do. Instead, they must make quarterly tax payments to cover both income tax and self-employment tax (Social Security and Medicare) on the income they earn. These payments help self-employed individuals stay on track with their tax obligations and avoid a large tax bill at the end of the year.

To calculate quarterly estimated tax payments, self-employed individuals typically use Form 1040-ES, which provides a worksheet for estimating taxable income, tax deductions, and self-employment tax. Estimated payments are due four times a year: April 15, June 15, September 15, and January 15 of the following year. Accurately calculating and paying these taxes on time helps avoid penalties.

If an individual underpays or misses a quarterly payment, the IRS may assess penalties and interest on the unpaid amount. These penalties can add up quickly, so it’s essential to estimate income accurately, keep track of earnings, and pay on time to avoid extra costs.

Deductions When Filing Taxes for Self-Employed Individuals

- Common deductions available, such as home office, business expenses, and health insurance premiums.

- Explanation of the Qualified Business Income (QBI) deduction.

- Tips on keeping records to support deductions and lower taxable income.

Deductions for self-employed individuals can significantly reduce taxable income, allowing them to retain more of their earnings. Common deductions include the home office deduction for those who use a portion of their home exclusively for business, enabling them to deduct a portion of rent or mortgage interest, utilities, and maintenance. Business expenses such as office supplies, software, travel, meals, and professional services are also deductible. Additionally, self-employed individuals can deduct health insurance premiums for themselves and their dependents, which can be a major tax benefit for those paying for their own coverage.

The Qualified Business Income (QBI) deduction allows eligible self-employed individuals to deduct up to 20% of their net business income, reducing taxable income without requiring additional spending. This deduction is subject to income limitations and varies depending on the type of business.

To maximize deductions, it’s essential for self-employed individuals to keep thorough records, such as receipts, invoices, and bank statements, which support each claimed expense. Using accounting software or hiring a tax professional can simplify tracking expenses, ensuring accuracy and helping self-employed taxpayers take full advantage of available deductions when filing taxes for self-employed income.

Tracking Income and Expenses

- Importance of maintaining organized records for income and business expenses.

- Tools and software recommendations for managing financial records.

- How accurate tracking can simplify tax filing and support deductions.

Diligent tracking of income and expenses through organized record-keeping and the right tools can make filing taxes for self-employed professionals a more manageable process.

Keeping detailed and organized records of your income and business expenses is essential for any self-employed professional. Organized records make it easier to identify potential deductions, track cash flow, and prepare for any potential audits. Without proper documentation, you risk missing out on valuable deductions or facing penalties from tax authorities.

To efficiently manage financial records, consider utilizing tools and software designed for self-employed individuals. Programs like QuickBooks, FreshBooks, or Xero offer features tailored to tracking income, categorizing expenses, and generating financial reports. Moreover, many of these platforms allow you to integrate your bank accounts and credit cards, providing a real-time overview of your financial situation.

Self-Employment Retirement Contributions

- Overview of retirement options for the self-employed (e.g., SEP IRA, Solo 401(k)).

- How retirement contributions can reduce taxable income.

- Contribution limits and tax benefits associated with self-employed retirement accounts.

Two popular choices are the Simplified Employee Pension (SEP) IRA and the Solo 401(k). A SEP IRA allows self-employed individuals to contribute a significant portion of their income, with contributions made by the employer (themselves) on behalf of their employees if applicable.

On the other hand, a Solo 401(k) offers the ability to contribute both as an employee and employer, allowing for even higher contribution limits. Contributions made to accounts like a SEP IRA or Solo 401(k) are often tax-deductible, which means they can lower your taxable income for the year.

For 2024, the contribution limit for a SEP IRA is up to 25% of your net self-employment income, up to a maximum of $66,000. In contrast, the Solo 401(k) allows for higher contributions, with the employee deferral limit being $22,500 (or $30,000 if you’re 50 or older) and an additional employer contribution limit that brings the total to $66,000 (or $73,500 for those aged 50 and over).

Deadlines for Filing Taxes for Self-Employed and How to File

- Key tax deadlines for self-employed individuals.

- Options for filing taxes: self-filing vs. using a tax professional.

- Pros and cons of using tax software specifically designed for self-employed individuals.

Understanding key deadlines and filing options is crucial for filing taxes for self-employed individuals. Tax returns are generally due on April 15, with extensions available until October 15, while estimated quarterly taxes for self-employed individuals are due on

- April 15

- June 15

- September 15

- January 15

Self-employed individuals can choose to self-file, which offers control and cost savings but requires a good grasp of tax laws, or hire a tax professional who can navigate complex situations but may charge higher fees.

Alternatively, tax software designed for self-employed individuals provides convenience and guidance for relevant deductions, though it may fall short in handling unique tax scenarios. By staying informed about deadlines and weighing filing options, self-employed individuals can streamline their tax process effectively.

Common Mistakes and How to Avoid Them

- Typical errors made when filing taxes for self-employed income.

- Tips on double-checking deductions, quarterly payments, and forms.

- Advice on when to seek help from a tax professional.

When filing taxes for self-employed individuals, it’s important to be aware of common mistakes that can lead to costly errors. Typical errors include miscalculating deductions, failing to keep accurate records, and neglecting to pay quarterly estimated taxes, which can result in penalties. To avoid these pitfalls, double-check your deductions, ensure you have organized financial records, and verify that all forms are completed accurately. If you find yourself overwhelmed by complex tax situations or unsure about your filing, it’s advisable to seek help from a tax professional who can provide guidance and ensure compliance. By staying vigilant and proactive, you can minimize mistakes and streamline the tax filing process.

Conclusion

- Final tips on staying organized, meeting deadlines, and maximizing deductions.

Successfully filing taxes for self-employed individuals involves several essential steps, including maintaining organized records, understanding key tax deadlines, and being aware of available deductions. To stay on top of your tax obligations, establish a consistent record-keeping system that tracks income and expenses, and use reliable tools or software to simplify the process.

Always mark important deadlines on your calendar to avoid penalties, and regularly review your deductions to maximize potential savings. Lastly, don’t hesitate to seek assistance from a tax professional if your situation becomes complex. By staying organized and proactive, you can navigate the tax landscape more effectively and ensure compliance while optimizing your financial outcomes.